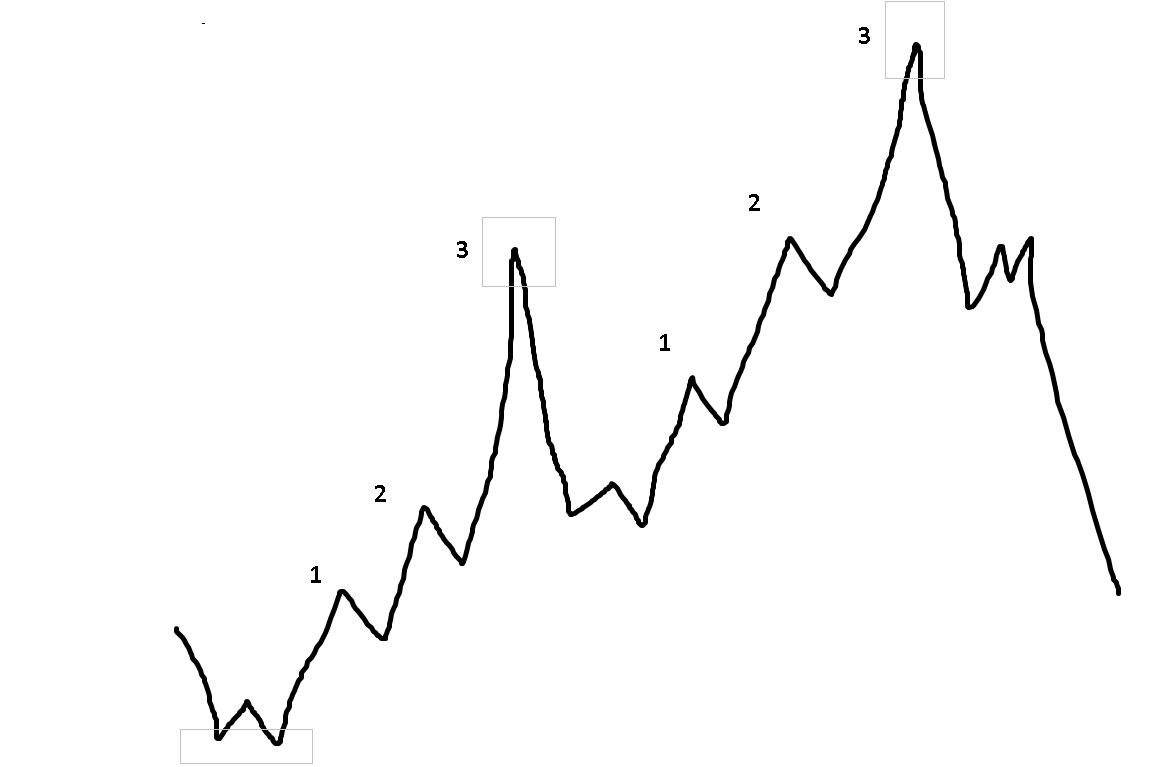

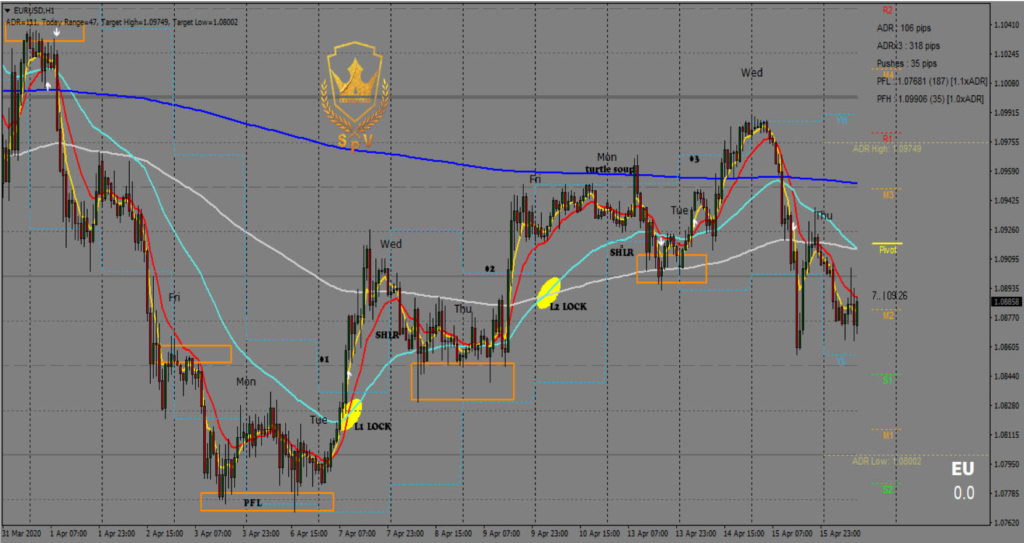

Trend lines analysis believe that the market moves in a channel with 3 touches on the trend line.

Basically, when the market trends it will be forming swing highs and swing lows. Now, if you want to follow the trend you must first know the different types of trends available in the market.

Types of Trends:

1. The technical trend

2. The market maker Trend

Day 01:

A reversal day is when the market shifts/ change in direction of the trend. Bullish to bearish or vice versa. Most of the time retail traders counter this move since the trend following strategy and indicators show a strong bullish or strong bearish momentum.

Trade under FxSway broker. Broker made by traders, for traders. Click the link to sign up now: https://fxsway.com/?refid=1625514873823

Day 02:

After the market has moved one level, you should expect an impulse swing as a false move to grab liquidity for the next move to unfold. Upon completion of level 2, there will be a crossover of 50 and 200 EMA. This also indicates that all other traditional indicators have fired a signal that there is a change in the trend. Trend following indicators are mathematical based indicators, and mostly they calculate the next best possible directional move based on a close of a candle »>usually several candles. So mostly they lag behind. Retail traders will also be allowed to draw trend lines after this level.

Day 3:

As retailors are waiting for a confirmation to entry, market makers will be looking forward to close their positions, run into levels of stop loss and reverse. This is level 3. Most retail traders enter at the end of level 3. Indicators + trend line confirmation would give them a strong momentum of the trend. Market makers must force their hands to commit. Price levels which are of interest to retail traders will be touched with several confirmations. Eventually market makers will apply the brakes and a reversal will be seen.

Learn more:

Trade under FxSway broker. Broker made by traders, for traders. Click the link to sign up now: https://fxsway.com/?refid=1625514873823

The differences between a market maker trader and a technical trader are the areas of entry, and the knowledge about the dealer’s sentiments. Market maker method has proved to be powerful and consistent in the forex market.

It is difficult to draw the trend line as price moves, you will be shifting it every time price breaks it. That’s the hard truth, I have been there, and it doesn’t work. The way smart money raid stop loss levels for retail traders is based on simple patterns. Simple analysis and you can find 3 levels in any pair you open now. But it is very difficult for price action patterns to settle in, it is difficult for you to find a falling or a rising wedge in every pair etc. etc. But these levels happen every day and in every pair. With this very simple logic, you need to ask yourself, what truly works?

With the market maker trend we have narrowed down the areas where price is supposed to reverse and a new trend to unfold. It’s not necessary for price to reach areas of support or resistance and reverse.

It is only when the dealer has run into a level of stop loss, grabbed the liquidity needed for a swing, then the market reverse.

Trade under FxSway broker. Broker made by traders, for traders. Click the link to sign up now: https://fxsway.com/?refid=1625514873823