IS PRICE MOVEMENT RANDOM?

There is a notion that price movement in financial markets is random and chaotic. Quarter theory suggest a clear pattern in price movement, challenging the notion that price movement is random. Quarter theory organizes the daily fluctuations of currency exchange in a systematic orderly manner.

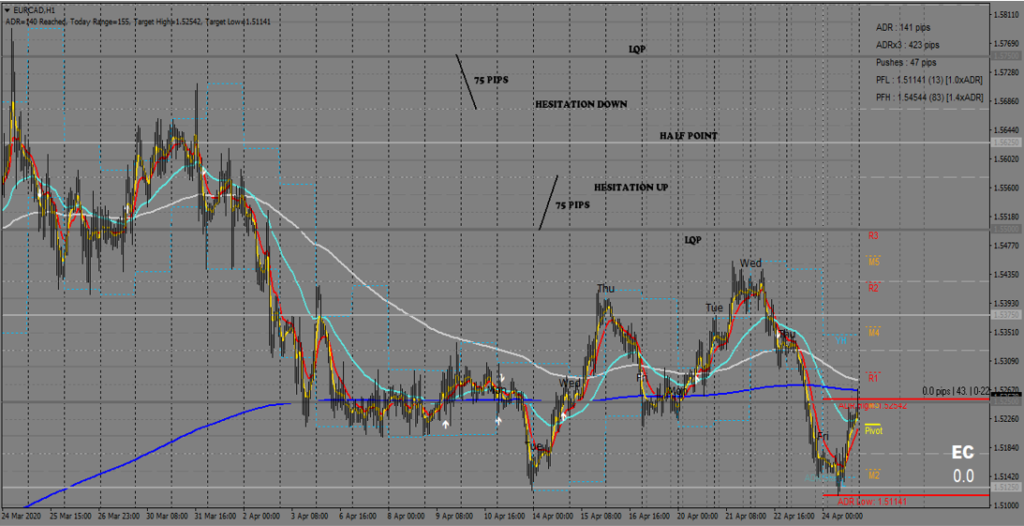

Quarters Theory focuses on the 1000 PIP Ranges between the Major Whole Numbers in currency exchange rates and divides these ranges into four equal parts, called Large Quarters. Each 1000 PIP Range contains four Large Quarters and each Large Quarter has exactly 250 PIPs (1000 PIP Range/4 = 250 PIPs).

The numbers that mark the beginning and the end of each Large Quarter are given the name Large Quarter Points(LQP). The Large Quarter Points that coincide with Major Whole Numbers are also called Major Large Quarter Points, because they represent critical junctions that signal the end of a previous and, at the same time, the beginning of a new 1000 PIP Range. The exact half point of each 1000 PIP Range coincides with a Large Quarter Point and is also called the Major Half Point of the 1000 PIP Range.

The Quarters Theory proposes that every significant price move in currency exchange rates takes place from one Large Quarter Point to another, in gradual increments of 250 PIPs, the range between two Large Quarter Points.

The Large Quarter Points serve as constant support/resistance levels, as well as familiar, invariable price targets. A bullish price breakout above a Large Quarter Point is expected to target the Large Quarter Point above, and a bearish breakout below a Large Quarter Point is likely to challenge the Large Quarter Point below.

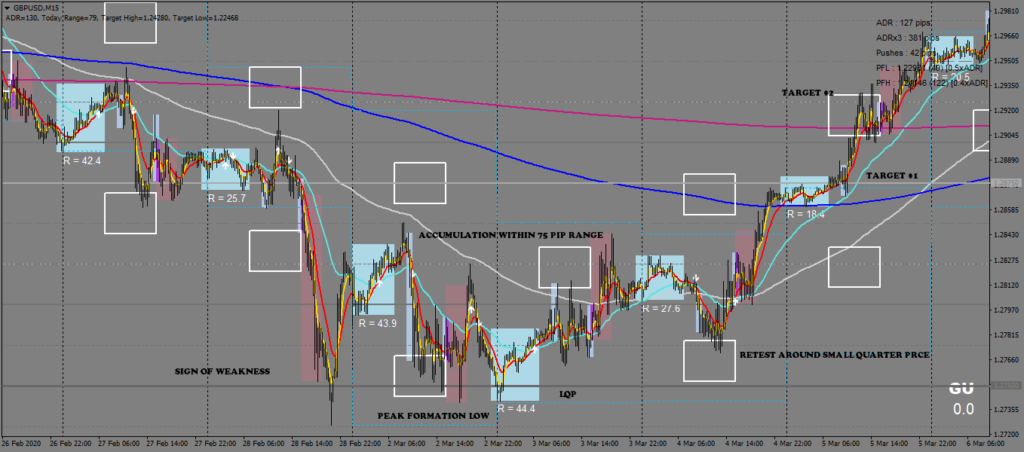

When a targeted Large Quarter Point is reached, the Large Quarter is considered to be completed. If prices fail to complete a Large Quarter, the unsuccessful completion of a Large Quarter usually causes a reversal that takes prices back toward the preceding Large Quarter Point.

The outcome of both events always leads to a price move that targets a familiar level—a Large Quarter Point. The repetitions of the series of Large Quarter completions from one Large Quarter point to the next, or reversals back toward a preceding Large Quarter Point as a result of unsuccessful completions, regularly manifest themselves as recognizable price patterns in the daily fluctuations of currency exchange rates.

The 100 PIP Ranges between two whole numbers in currency exchange rates are also divided by The Quarters Theory into four equal parts called Small Quarters. Each 100 PIP Range contains four Small Quarters and each Small Quarter has exactly 25 PIPs (100 PIP Range/4 = 25 PIPs). The numbers that mark the beginning and the end of each Small Quarter are given the name Small Quarter Points.

Currency exchange rates fluctuate in orderly series of price moves from one Small Quarter Point to the next, measured in increments of 25 PIPs, in a systematic effort to complete an entire Large Quarter of 250 PIPs.

What if prices actually break above or below a Large Quarter Point and transition into a new Large Quarter? Does a Large Quarter Transition mean that the new Large Quarter will be successfully completed?

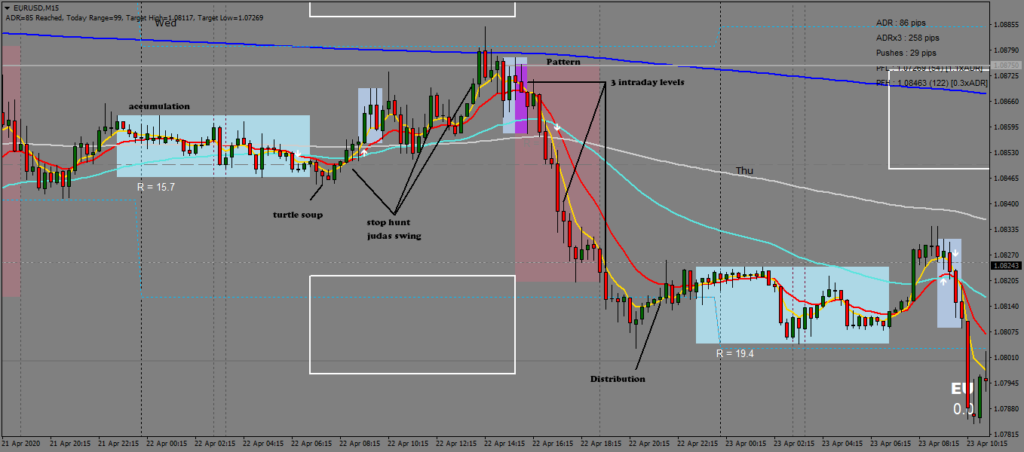

The Quarters Theory recognizes that Large Quarter Transitions do not guarantee the successful completion of a Large Quarter and that price behavior of currency exchange rates within the actual Large Quarters should be closely analyzed for signs of strength that could lead to the successful completion of a Large Quarter, or signs of weakness and exhaustion that may cause unsuccessful Large Quarter completion and reversals back toward the preceding Large Quarter Point.

In order to monitor the price behavior of currency exchange rates within the range of each Large Quarter, The Quarters Theory establishes three important price levels within each Large Quarter:

– The End of the Hesitation Zone,

– The Half Point, and

– The Whole Number preceding a Large Quarter Point (25 PIPs).

These three important price points within each Large Quarter serve as major support and resistance levels that may prevent further price progression and may cause unsuccessful completion of a Large Quarter.

HESITATION ZONE:

The Hesitation Zone is the range of 75 PIPs above or below a Large Quarter Point. The Hesitation Zone is formed by the first three Small Quarters of 25 PIPs of each Large Quarter.

The Quarters Theory uses the Hesitation Zone to identify successful or failed Large Quarter Transitions by distinguishing between decisive and indecisive entrance of prices into a new Large Quarter.

If prices stay confined within the Hesitation Zone, the End of the Hesitation Zone can prove to be a difficult support or resistance level to overcome and may prevent further progression of prices beyond the range of the Hesitation Zone, leading to price exhaustion and unsuccessful completion of a Large Quarter.

Only decisive price moves that target the end of the Hesitation Zone and do not break above (or below) the preceding Large Quarter Point on pullbacks are considered to be an indication of a successful Large Quarter Transition.

USES

Quarters integrated with the market maker method allows you to add extra confluence in your trading decisions. Price extensions after a cycle is complete often occur to find the next LQP and reverse at the exact price level. This means the LQPs can be registered as high, low, open or close during normal market conditions.

MQP alloy has integrated the quarters well, Q stands for Quarter theory. If you look at the bookmap feed(futures orderbook), you will find prices reflected are in form of whole number prices, that is a simple example of how these quarter numbers are important.

Learn more about MQP alloy: https://forexspv.com/training/

Trade under FxSway broker. Broker made by traders, for traders. Click the link to sign up now: https://fxsway.com/?refid=1625514873823