Session-Based Tactics & SMT Divergence Explained

When traders think of financial markets, Forex often comes to mind first. But beyond currency pairs lies a powerful, often underutilized arena — indices trading. Indices like the NASDAQ 100, S&P 500, and Dow Jones Industrial Average represent major portions of the global stock market, offering high-volume, high-reward opportunities for modern investors.

In this article, we explore the logic behind trading these indices using session-based entry tactics and the SMT divergence concept, all from the MQP Alloy perspective used at ForexSPV.

Why Trade Indices?

Indices are collections of top-performing stocks bundled into one tradable instrument. For example:

- NASDAQ 100 (NAS100) includes leading non-financial tech giants like Apple, Google, and Meta.

- S&P 500 (SPX500) tracks the 500 largest companies in the U.S.

- Dow Jones (US30) follows 30 blue-chip companies representing the U.S. economy.

These indices offer:

- 🔹 Higher average daily range (ADR) = larger pip movement

- 🔹 Strong reaction to macroeconomic news and fundamentals

- 🔹 Low spread trading with consistent volatility during major sessions

Session-Based Entry Strategy

Trading indices successfully involves timing. The London and New York sessions offer the most reliable liquidity and volatility — ideal for intraday entries.

🔹 Key Tips:

- London Open (8AM GMT): Ideal for breakouts after Asia’s range consolidation

- NY Overlap (12PM–4PM GMT): High momentum, especially on NASDAQ and SPX

- NY Close (9PM GMT): Can be used for end-of-day setups or scaling out

At ForexSPV, we teach students to enter in line with market manipulation patterns, typically during overlaps when big money enters.

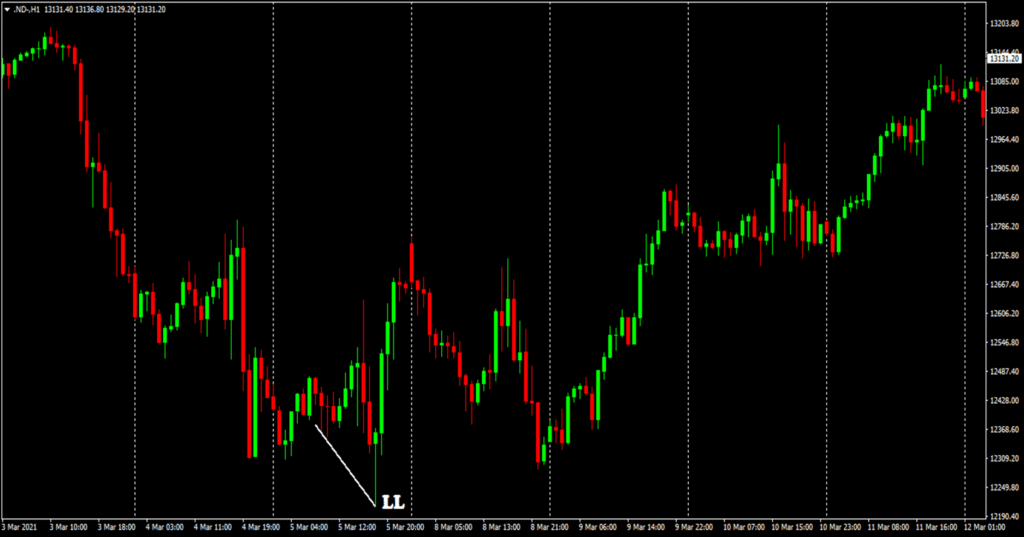

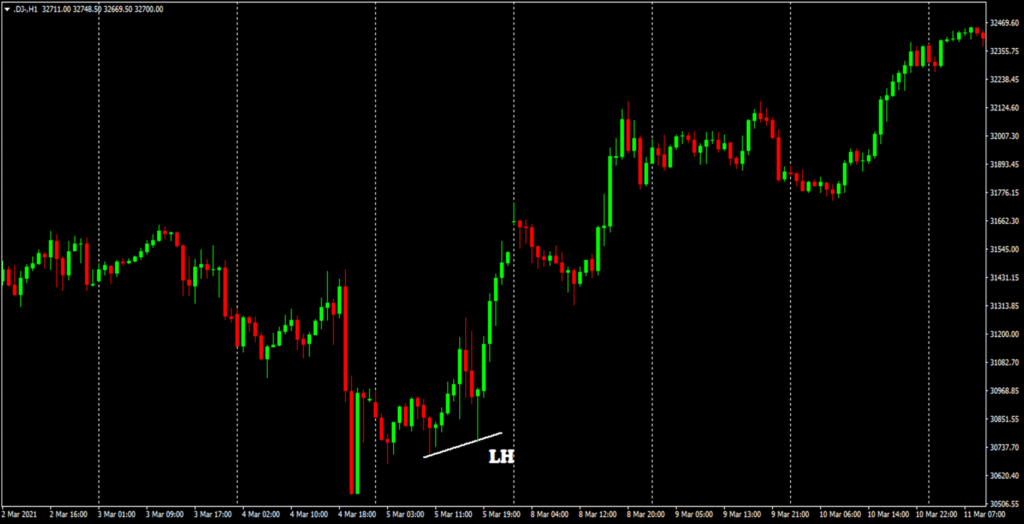

SMT Divergence: Smart Money Tactic

SMT (Smart Money Tool) Divergence is a technique where we compare the structure of related instruments (e.g., S&P vs NASDAQ). If one index makes a higher high and the other fails to follow, it may signal institutional distribution or absorption.

Example:

- NASDAQ prints a higher high, but S&P500 prints a lower high

→ Smart money could be manipulating retail longs on NASDAQ while selling SPX behind the scenes.

This is a powerful confluence tool in MQP Alloy for confirming high-probability reversal zones.

MQP Alloy: The Strategy Behind the Trade

All trades taught at ForexSPV — including indices — are based on MQP Alloy, a strategy combining:

- Market Maker Method

- Quarter Theory

- Price Action

When applied to indices:

- Entries are aligned with manipulation zones (stop hunts, fake breakouts)

- Timing is refined to session windows

- Exit levels are mapped using higher time frame market structure

Final Thoughts

While Forex remains king in terms of volume, indices like NASDAQ, Dow, and S&P offer structured opportunities for those who understand timing, manipulation, and divergence. With the right strategy, they can be a powerful addition to your trading arsenal.

💡 At ForexSPV, we’re not just teaching you how to trade — we’re teaching you to think like the institutions.

🎥 Want to dive deeper into the strategy?

👉 Watch our Free Indices Training Series on YouTube

📞 For mentorship or training, WhatsApp us: +255 682 199 639

🌐 Visit: www.forexspv.com

Disclaimer: Trading indices, Forex, and CFDs is speculative and carries high risk. Always use risk capital and never trade funds you cannot afford to lose. This article is for educational purposes only and not financial advice.