In the world of forex, news releases are not just announcements—they’re opportunities. When approached strategically, high-impact news events like Non-Farm Payroll (NFP), CPI, FOMC statements, and central bank rate decisions can present sharp, profitable price movements.

At ForexSPV, we train traders to capitalize on this volatility using precise technical methods, smart timing, and strict risk control. This isn’t about gambling on news outcomes. This is about anticipating market reaction using real dealer behavior and structure.

Why News Trading?

Every week, financial markets react to high-impact economic news—from NFP (Non-Farm Payrolls) to interest rate decisions. These “red folder” events (as shown on ForexFactory) can shift entire trading zones within seconds. When you understand how the dealers and institutional players move, you can profit without being slaughtered like the retail herd.

- Volatility = Opportunity: Big price swings = big profits — but only for the prepared.

- Precision Profits: You can earn 50–100 pips in seconds with the right entry.

- Market Reaction > News Outcome: We don’t care about the number. We care how the market moves.

- Market Maker Behavior: Most traders get trapped by fake moves. We teach how to spot them.

What Happens Before the News Hits:

High-impact news can make or break a trading account. That’s why preparation is key:

- Lower leverage: Brokers automatically reduce leverage ahead of major releases. This isn’t a punishment—it’s protection.

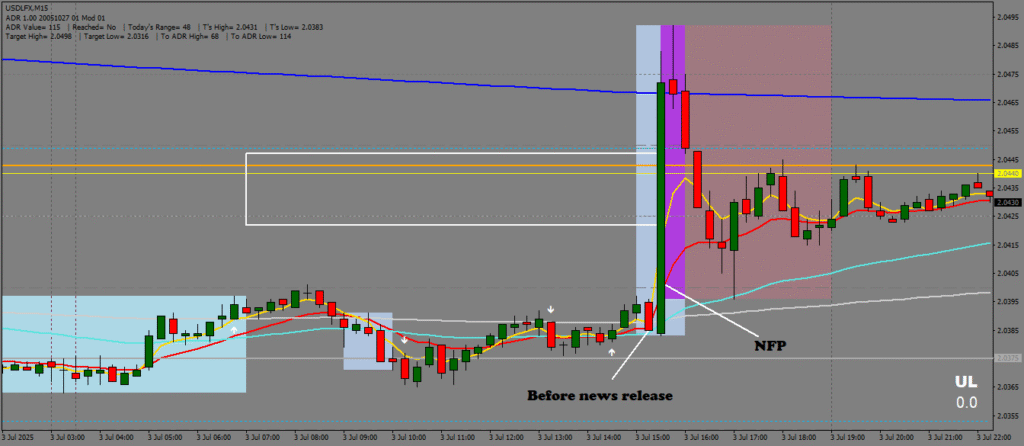

- Avoid pending orders: Many retail traders gamble with buy stops or sell limits. Dealers exploit this by widening spreads and triggering early stop hunts.

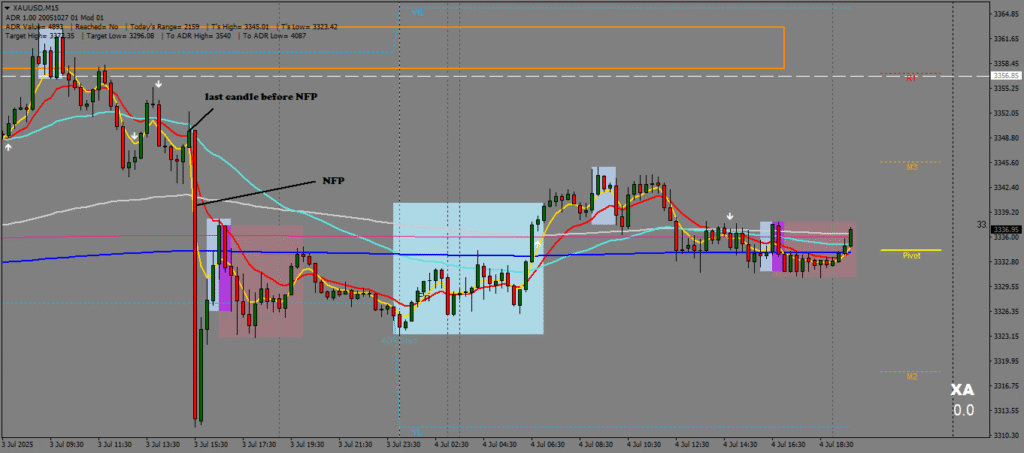

- Observe the last candle: The final 5–10 minutes before a release can reveal the dealer’s intentions. Watch closely—it’s often a fake move to trap retail traders.

- Know your ADR & key levels: Where’s price relative to its average daily range? Is it near support/resistance? These clues help you anticipate the real move after the spike.

Dealer Traps to Avoid

Before news releases, market makers (dealers) often:

- Create fake moves (e.g., push price one way to trap traders)

- Manipulate candle formations to appear as breakouts or breakdowns

- Sweep liquidity zones to hit stop losses before the real move

🔍 What Really Happens During News Releases?

Most traders think news trading is risky. And it is—if you don’t know what you’re doing. But with the MQP Alloy Strategy, we’ve developed a reliable approach to catch explosive moves with calculated risk.

Here’s how we do it:

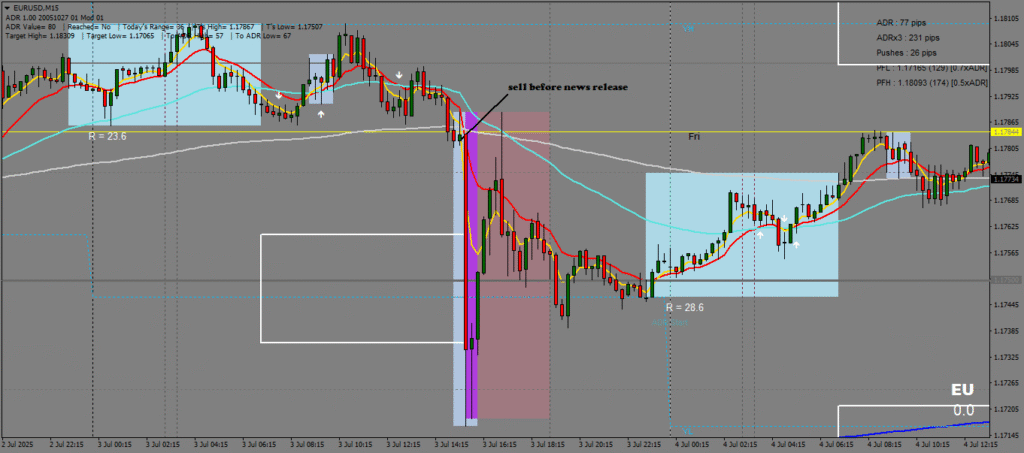

- Pre-News Setup: We analyze the market structure and identify the most recent dealer behavior (especially the last candle before news). This candle often signals a fake direction used to trap retail traders before the true move begins.

- Timing the Entry: We enter 3–5 minutes before the news release (e.g., at 15:25–15:28 if the news is at 15:30). This is the sweet spot where price reacts to dealer manipulation—not to the news number itself.

- The Spike: As the news is released, volatility spikes. In just a few seconds, we can secure 50–100 pips. Our trades don’t rely on the outcome of the news but on how the market reacts technically in the first moments.

Our Timing & Execution at ForexSPV

We don’t wait for the news outcome. We position ourselves just before release.

- Entry Time: 3–5 minutes before news (e.g., 15:25–15:28 for a 15:30 release)

- Strategy: Use MQP Alloy to identify dealer zones

- Execution: Market order with predetermined SL and TP

- Target: Secure 50–100 pips within seconds to minutes

We use 15M timeframes for analysis, but align it with market structure from higher timeframes and recent dealer cycles.

Stop Loss, Risk & Capital Management

News spikes can wipe out reckless traders. Here’s how we protect our capital:

- Stop Loss: Always placed below/above the fake move candle, 15 to 23 pips.

- Risk: 1–2% of capital per trade max

- Risk-Reward Ratio: Targeting 1:3 or better

- No Overtrading: One setup is enough. Choose based on disparity.

🔔 Key High-Impact News Events We Trade

- Non-Farm Payrolls (NFP)

- Interest Rates

- FOMC Statements & Fed Rate Decisions

- CPI & Inflation Reports

- Central Bank Speeches (e.g., Powell, Lagarde)

- Employment & GDP Reports

Fundamental vs Volatility Traders

Fundamental traders (banks, hedge funds, macro analysts) enter after analyzing the data and often trade long-term impact.

At ForexSPV, we teach the short-term volatility method: Trade the dealer’s reaction, not the report. The long-term effect is later.

We also offer a Fundamental Analysis Book covering macro trading strategies and long-term impacts.

Real Results, Real Strategy: NFP Case Recap

In last week’s NFP release, we anticipated a strong dollar. But 10 minutes before the release, the market showed dollar weakness—classic dealer trap. Just before the data dropped, we had already positioned ourselves to sell GBPUSD and EURUSD, and within seconds of the release, the market moved in our favor. TP hit. ✅

This is what we train our traders to spot: the real intention behind the price action, not just the data.

This is how we train. This is how we trade.

Final Word

News trading doesn’t have to burn your account. With structure, discipline, and an understanding of market maker behavior, you can profit from volatility instead of being its victim.

🎓 Ready to Learn the Art of News Trading?

📚 Join our mentorship & signal programs at www.forexspv.com/

📘 Grab our Books

📲 Telegram Channel: @forexspv

📺 YouTube Lessons: ForexSPV YouTube