In trading, consistency beats perfection. The real edge isn’t just found in strategies — it’s in the daily repetition of a disciplined routine. Every profitable trader understands this: the market rewards structure, not randomness. This blog post breaks down how to build a repeatable routine using the MQP Alloy strategy and why your success depends on process over outcome.

1. The Power of Daily Markups

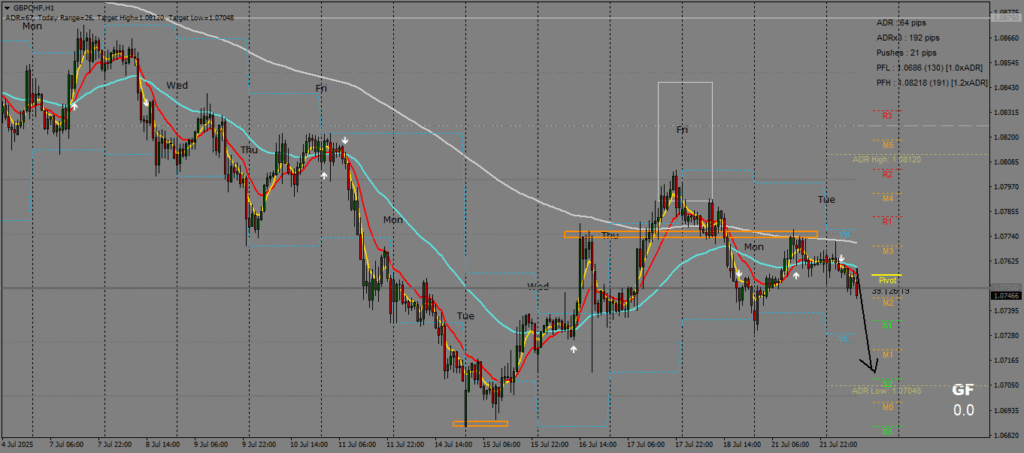

Before the market even opens, your day should start with one task: marking up your charts.

This includes:

- Identifying previous day’s highs/lows

- Marking institutional zones and stop hunt areas

- Drawing intraday liquidity pools and dealer manipulation zones

As clearly stated in Rule #1 of the MQP Alloy system:

“Mark-up your charts every day. Anticipate stop hunt zone and entry zones, a day before it happens.”

This habit sets the tone. Without a markup, you’re not trading — you’re gambling.

2. Anticipate the Dealer’s Behavior, Not the Market’s Direction

One of the biggest mindset shifts in MQP Alloy is this:

“Trade when the dealer has hit the stops.”

This doesn’t mean waiting for confirmation from RSI or indicators. It means understanding the manipulation behavior of smart money — the why behind the movement. In fact, Rule #9 makes it crystal clear:

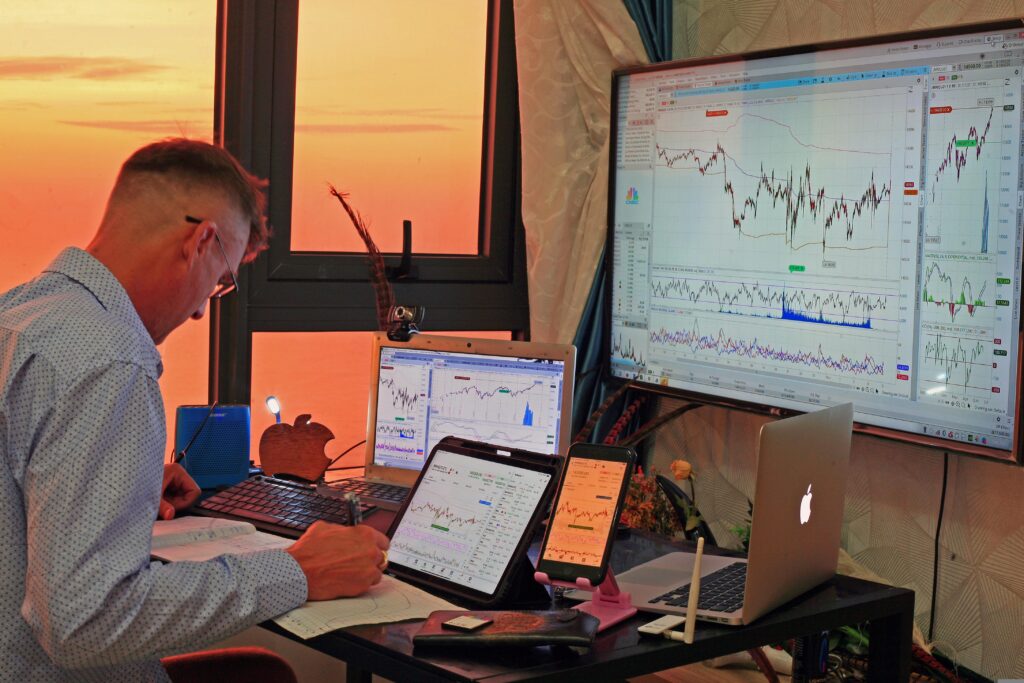

“Do Not ANALYSE Using Your F*cking Phone.”

This isn’t just about screen size or distractions — it’s about tool access.

Our analysis template — which includes all necessary tools, institutional levels, session zones, and dealer behavior cues — is only available on the desktop versions of MT4 or MT5.

Without that template, you’re analyzing blind. You miss critical confirmations that are core to the MQP Alloy methodology.

So when we say don’t analyze on your phone, it’s because you won’t have the structure and tools that make the MQP system work.

Phones are for monitoring trades — not for making strategic decisions.

3. Journal the Setup – Not Just the Results

Once your markup is ready and you’ve entered a trade, log it immediately — entry point, reason for entry, bias, and your exit plan. This allows you to track patterns over time.

Don’t just celebrate profits. Learn from the process.

As the MQP Alloy book emphasizes:

“Rather than aiming to make many pips per day to achieve your income targets, use a method which is highly reliable and ramp up your contract size.”

This encourages mastery over randomness.

4. Be Comfortable With the “Grey Area”

Markets are never perfect. Stop waiting for 100% clarity.

“There is no perfect scenario, don’t expect 100%. There is no ‘black & white’.”

Every day won’t look clean. That’s okay. The goal isn’t to win every trade — it’s to execute the right process every time.

Conclusion: Process Over Outcome

The most consistent traders aren’t emotional about wins or losses. They focus on their routine.

- Daily markups

- Anticipation of dealer moves

- Avoiding emotional impulses

- Staying off mobile charts

- Journaling every trade

Repeat that long enough, and the market won’t be a gamble — it will be a business.

Want to learn the MQP Alloy system and access our trade signals?

📲 DM us on Instagram @forexspv

🌍 Visit: www.forexspv.com

📞 WhatsApp: +255 682 199 639

#TradeSmart #ForexSPV #MQPAlloy #TradingDiscipline #ForexEducation #ChartMarkup #InstitutionalTrading #StopHuntLogic #ProcessOverOutcome #ForexRoutine