FTMO (ForTheMarket) is a prominent prop firm offering funded accounts to aspiring traders. This case study delves into the details of FTMO, exploring its account options, evaluation challenges, fees, and the overall experience it provides.

FTMO Account Options:

FTMO offers a tiered system of funded accounts, allowing traders to progress based on their performance:

- Challenge Account: Available in various account sizes (ranging from $10,000 to $200,000), these accounts require passing a two-stage evaluation process.

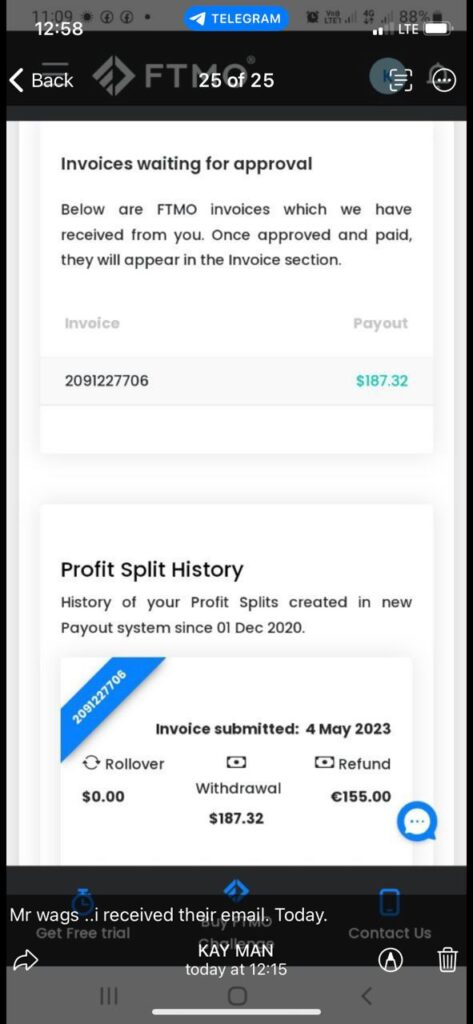

- Verified Account: Upon successful completion of the challenge, traders gain access to a verified account with the same size as their challenge account. Here, they keep a profitable share of earnings (up to 90%) with FTMO retaining the rest.

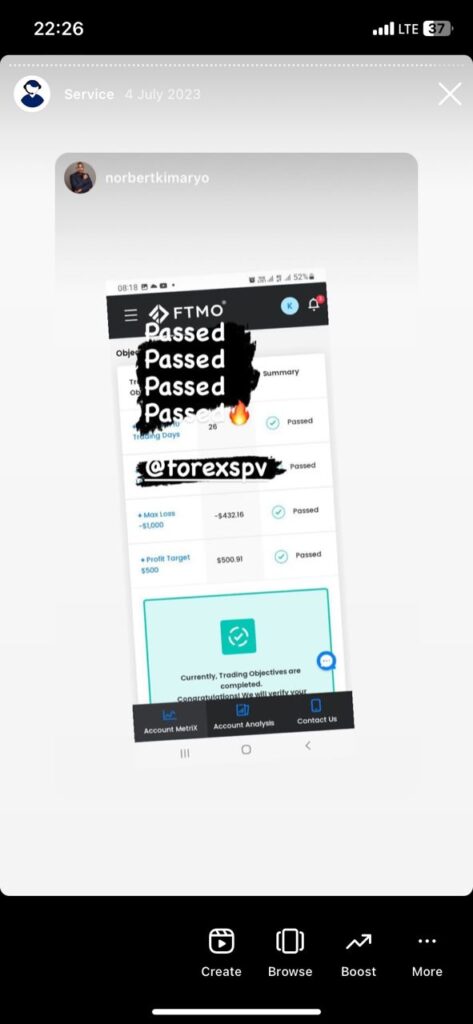

The FTMO Challenge:

There are two parts to the FTMO Challenge:

- Profit Target: Achieve a specific profit target (two phase, 10% profit target phase 1, 5% profit target phase 2) within a set timeframe (unlimited time limit).

- Maximum Drawdown: Maintain a maximum drawdown (percentage of account value that can be lost, 5% daily drawdown and 10% overall drawdown) throughout the challenge.

FTMO provides detailed information and video tutorials explaining the challenge rules https://ftmo.com/en/faq/step-1-ftmo-challenge/.

Fees:

FTMO charges a one-time fee for access to the challenge, which varies depending on the chosen account size. The fee is non-refundable if the trader fails the challenge. Refundable on first withdraw once a trader becomes a verified ftmo trader.

Evaluation Process:

The evaluation process is designed to assess a trader’s discipline, risk management, and overall trading competency. It emphasizes consistency and adherence to FTMO’s rules.

Benefits of FTMO Funded Accounts:

- Access to Large Capital: FTMO allows traders to manage significant capital, enabling them to amplify potential returns and experience real-world trading dynamics.

- Reduced Risk: Traders utilize FTMO’s capital, minimizing their financial risk compared to using personal funds.

- Performance-Based Earnings: FTMO incentivizes success by offering a share of the profits generated in verified accounts.

Potential Drawbacks:

- Challenge Difficulty: Passing the FTMO Challenge can be demanding, requiring discipline and adherence to strict rules.

- Evaluation Fees: The one-time challenge fee can be a barrier for some aspiring traders.

- Profit Sharing: Traders relinquish a portion of their profits to FTMO in verified accounts.

Is FTMO Right for You?

FTMO offers a compelling opportunity for experienced traders with a well-defined trading strategy and a strong foundation in risk management. However, the challenge can be rigorous, and the fees might not be suitable for everyone.

Alternatives to FTMO:

Several other prop firms offer funded accounts, each with its own evaluation process, fees, and profit-sharing structure. It’s essential to research and compare options before choosing a prop firm that aligns with your trading goals and risk tolerance.

User Reviews and Experiences:

Finding user reviews and experiences with FTMO can be a valuable resource. While some online reviews exist on forums and social media, be cautious and prioritize reviews from reputable sources.

Conclusion:

FTMO provides a well-structured path for aspiring traders to access substantial capital and potentially launch a successful trading career. However, careful consideration of the challenges, fees, and profit-sharing structure is crucial before taking the plunge.