If you’ve been trading without looking at the Commitment of Traders (COT) report, you’re likely missing out on one of the most powerful tools for understanding the market’s deeper psychology.

Each week, the COT report gives us a window into how the big players are positioned—hedge funds, banks, institutions, and even producers. It’s like eavesdropping on the thoughts of those who move the market.

What Is the COT Report?

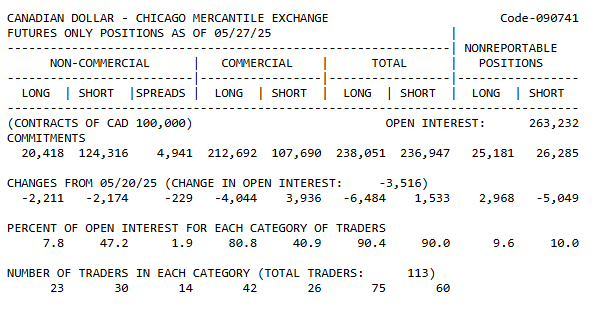

The COT report is released weekly by regulators to show the net long and short positions held by:

- Commercial Traders (Hedgers): These are the producers or users of a commodity or asset. They trade for protection, not profit.

- Non-Commercial Traders (Speculators): Think of hedge funds and big speculators. They’re in it for the money, just like us.

- Retail/Small Traders: These are the “non-reportables.” Their positions are too small to shake the market, but they still count.

Why It Matters for You

If you can understand how the big money is positioned, you’re already ahead of most traders.

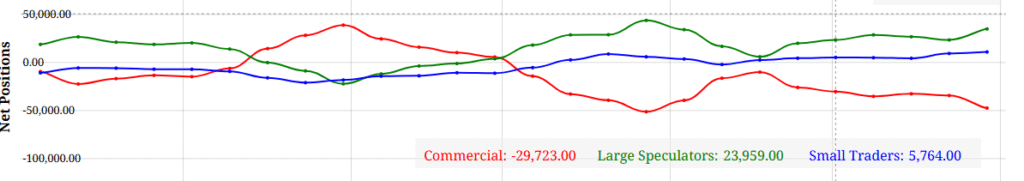

Example: If non-commercial traders are stacking up long positions on gold week after week, that’s a clue. The “smart money” is betting long-term bullish. When these positions hit extreme levels, you may also spot potential reversals.

This isn’t a tool for 15-minute scalps. It’s for those who want a swing or position trade edge—traders who want to align with the real momentum behind the charts.

How to Read the COT Like a Pro

- Focus on Non-Commercials: These are the trendsetters. Their net long or short positions give you directional bias.

- Look for Extremes: If net longs are hitting record highs, caution—markets may reverse.

- Compare with Price Action: If positioning grows bullish but price doesn’t follow, something’s off. Be patient.

- Check for Divergence: If the market is falling, but non-commercials are adding long positions, a reversal could be brewing.

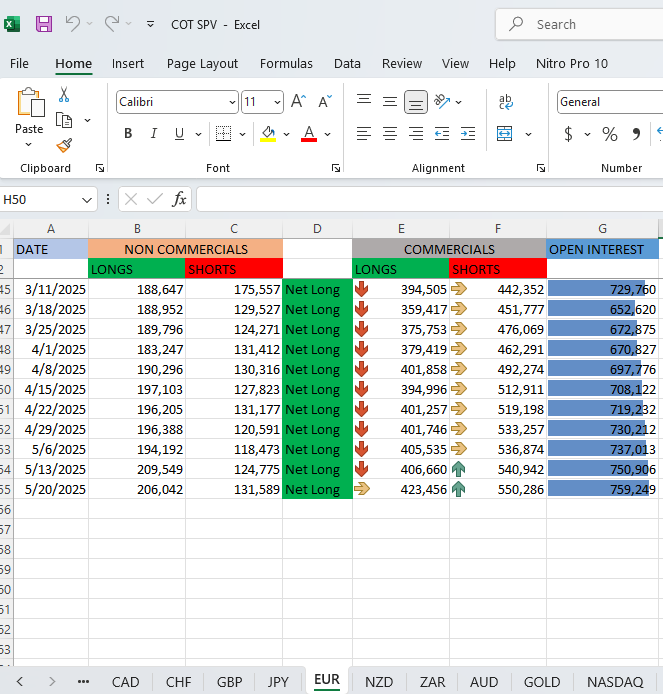

Turn the Data into Direction

Let’s say you’ve been watching EUR/USD. Over several weeks, non-commercial traders have been loading up on shorts on EURO, longs on DXY. Now the market breaks a key support level. You’ve just confirmed the bearish sentiment from both positioning and price action.

That’s confluence. That’s power.

The Trader’s Advantage

The COT report isn’t about predictions. It’s about preparation.

Use it weekly, not daily. Match the data with your technicals. It will give you the edge that most retail traders never use—because they don’t know it exists, or they’re too lazy to dig into it.

But you’re not like them. You’re leveling up.

Final Word

Professional traders don’t just chase setups—they understand why the market moves. The COT report helps you trade with the institutions, not against them.

So the next time you open your chart, ask yourself: what are the big players doing?

Because if you’re serious about growing in this game, sentiment isn’t optional—it’s your secret weapon.