By ForexSPV | MQP Alloy Strategy

In forex trading, many people think price moves randomly — up and down without order. But at ForexSPV, we teach something different. We use a method called the Quarters Theory inside the MQP Alloy Strategy, which shows that price often follows a simple, repeated structure.

This article will help you understand how this theory works and why it matters.

What is the Quarters Theory?

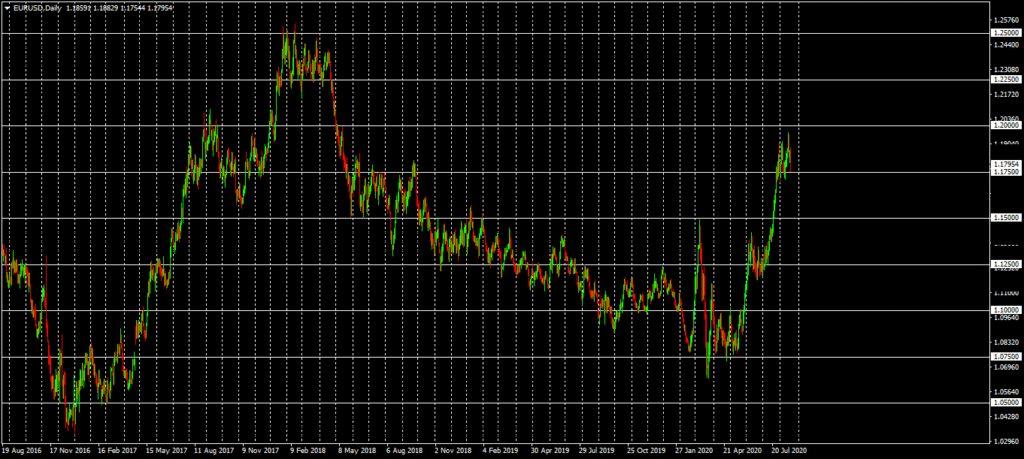

The Quarters Theory is based on the idea that price moves in organized sections, not randomly. It divides the market into fixed price levels that act like floors and ceilings. These levels are based on Major Whole Numbers — clean, round prices like 1.2000 or 1.2500.

From one major level to the next is a 1,000 pip range. That range is divided into 4 Large Quarters, each covering 250 pips.

So for example:

- 1.2000 to 1.2250 = Large Quarter 1

- 1.2250 to 1.2500 = Large Quarter 2

…and so on.

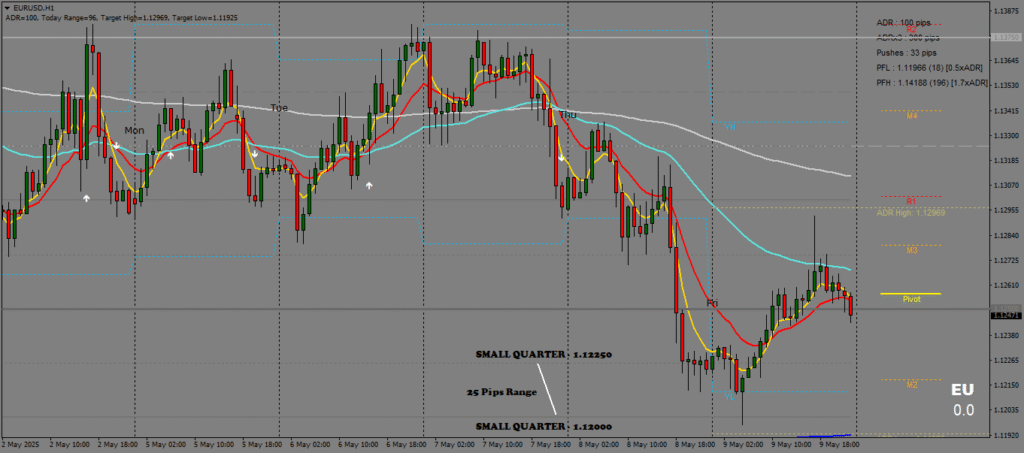

Each Large Quarter is also split into 10 smaller zones of 25 pips. This helps us see how price behaves on a smaller scale.

Why it Matters

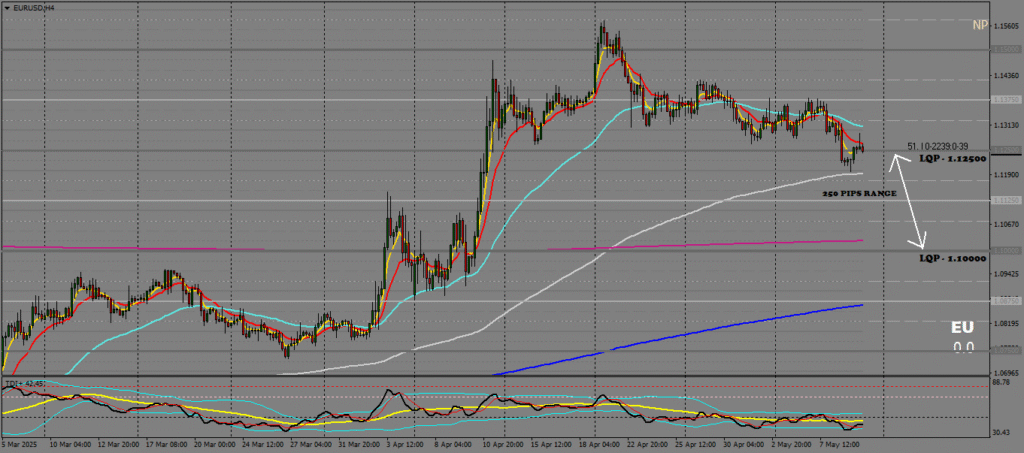

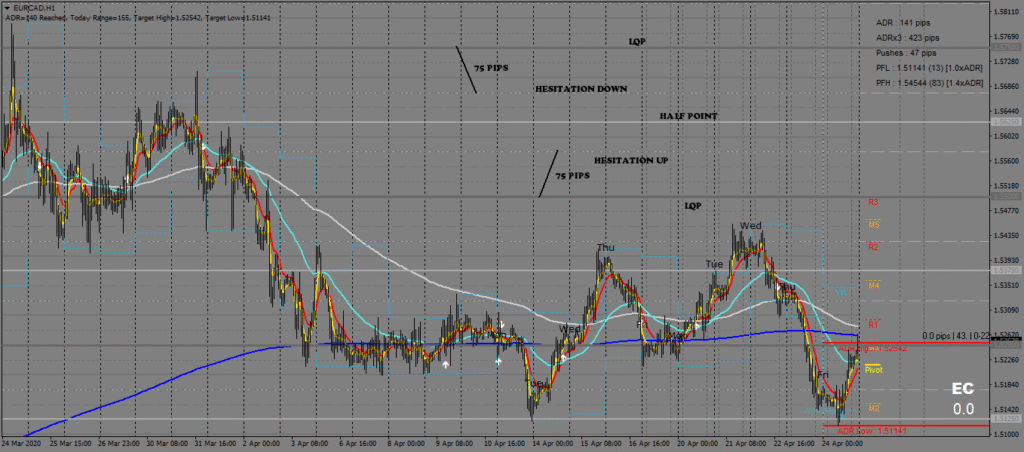

These levels are not just for show. In fact, price often moves from one Large Quarter Point (LQP) to the next. It may stop, correct, consolidate or reverse at these levels. When price fails to continue past a certain LQP, it may return back to the previous one.

This helps traders know:

- Where price may turn

- Where to set targets

- Where to avoid chasing trades

In simple words: it gives us structure and guidance.

How We Use It in MQP Alloy

In our MQP Alloy system, we don’t trade randomly. We wait for price to approach or break a Large Quarter Point. But we don’t just buy or sell blindly.

Here’s what we look for:

- If price is moving toward a new LQP but stalls before reaching it, that may be a sign of weakness.

- If price overshoots an LQP slightly but then drops back, it might be a fake breakout.

- If price reaches a new quarter and holds strong, we might expect it to continue to the next 250-pip zone.

We also connect this with stop hunts and liquidity zones. Often, price will take out trader’s stop losses at a quarter point before showing the real move. That’s why we wait for confirmation after the stop hunt, not before.

Key Zones to Watch

Inside each quarter, there are two important areas:

- Hesitation Zone (first 75 pips into a new quarter): If price slows here, be careful.

- Overshoot/Undershoot Zone (25 pips beyond/before a large quarter point): Price may fall short, or fake breakout beyond the LQP, Price ussually remained confined within these zones.

These zones help us avoid traps, and predict a successful or unsuccessful completion of a large quarter (250 pips range).

Conclusion

The Quarters Theory gives traders a simple, organized view of the market. It shows that price often moves in clear steps — not chaos.

At ForexSPV, we use this theory to help our students:

- See price more clearly

- Do quick and precise price analysis

- Avoid emotional decisions

- Trade with structure and patience

You don’t need to guess where price is going. You need a system that makes sense. The Quarters Theory is part of that system.

If you’re learning forex and want to trade with more structure, the Quarters Theory is a great place to start.

At ForexSPV, we use this concept as part of the MQP Alloy Strategy to help traders build consistency and clarity in the market.

To explore more topics like this and apply them with guidance, you can check out what we offer at:

📩 WhatsApp: +255 682 199 639

🌐 Website: www.forexspv.com

Disclaimer: Trading Forex and CFDs carries risk. Always trade with caution and discipline.