Introduction: The Invisible Forces Shaping Your Trades

Have you ever placed a stop-loss only to watch prices reverse moments after hitting it? Or witnessed a “textbook” breakout fail spectacularly? These aren’t random market quirks—they’re orchestrated moves by market makers (MMs), the institutions that control liquidity and price action behind the scenes. In this post, we’ll decode their tactics—M/W patterns, stop hunts, and liquidity manipulation—so you can anticipate their moves and trade strategically.

Who Are Market Makers?

Market makers are large financial entities (banks, brokers, or institutions) responsible for maintaining liquidity in the Forex market. They profit by:

- Earning the spread (the gap between bid and ask prices).

- Acting as counterparties to retail traders’ losing positions.

- Engineering price movements to trigger stop-losses and create profitable setups.

In short: Your losses often fuel their gains.

M/W Patterns: The Institutional Trap

Market makers use M and W chart patterns to trick retail traders into false breakouts or breakdowns. Here’s how to spot them:

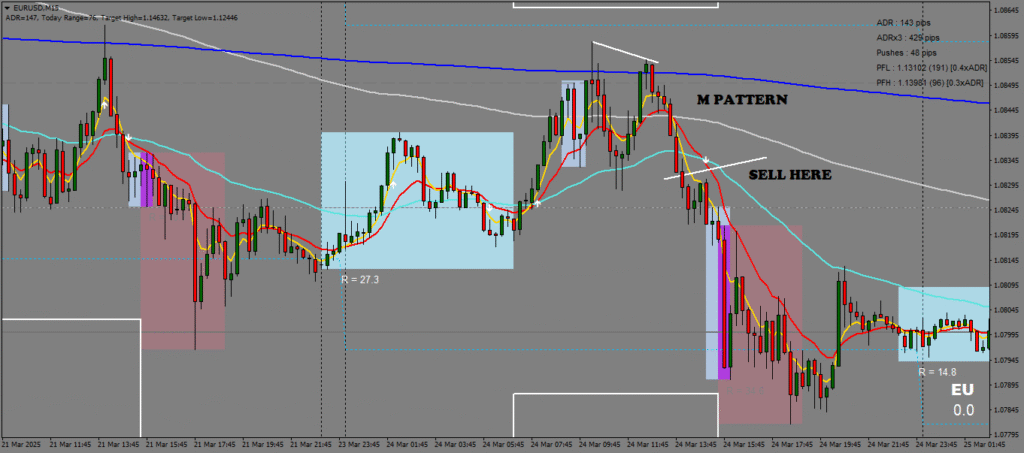

1. The M Pattern (Bearish Reversal)

- Formation: Two peaks resembling an “M” during an uptrend.

- Trap: Buyers pile in at the second peak, expecting a continuation. Instead, prices reverse sharply downward.

- Example: EUR/USD rallies to previous HOD (a psychological level), forms an M pattern, then crashes 150 pips.

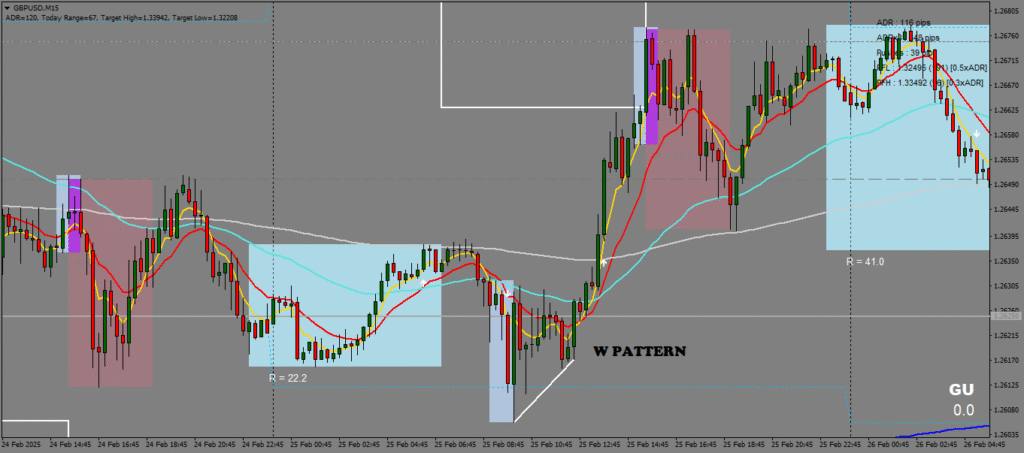

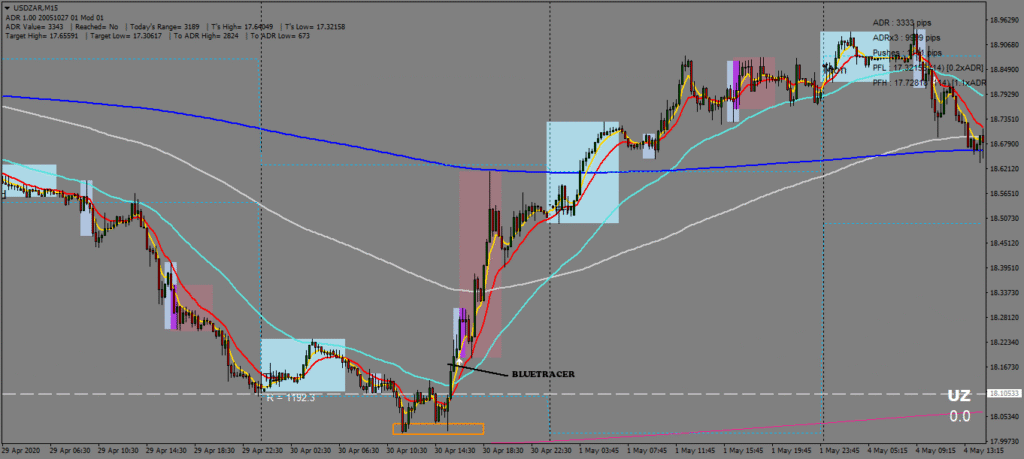

2. The W Pattern (Bullish Reversal)

- Formation: Two troughs resembling a “W” during a downtrend.

- Trap: Sellers short at the second trough, expecting new lows. Prices then rally aggressively.

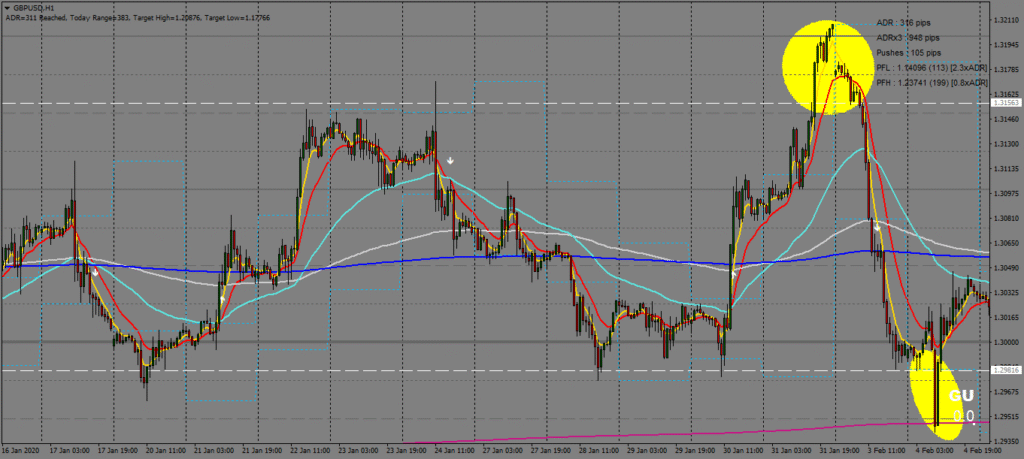

- Example: GBP/USD breaks below previous low, forms a W pattern, and surges 200 pips.

Why It Matters: These patterns aren’t random—they’re deliberate traps set to exploit retail traders’ herd mentality.

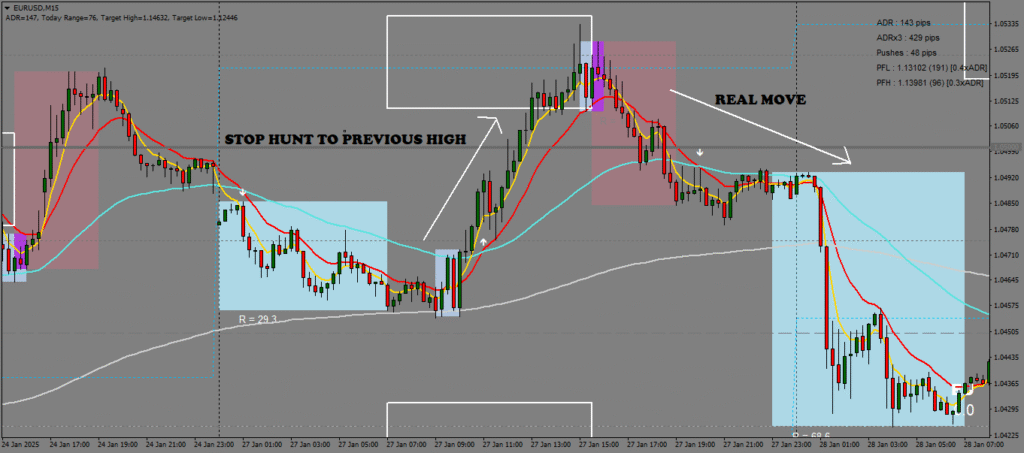

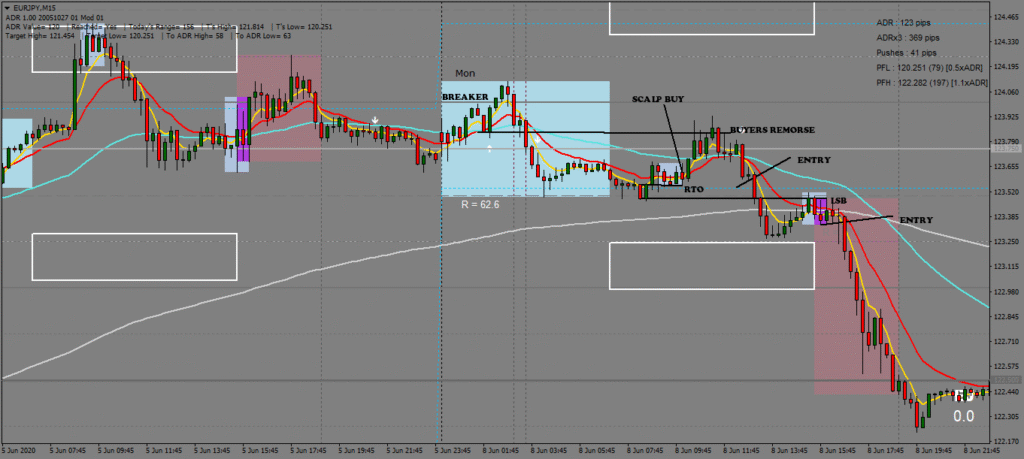

Stop Hunts: How Market Makers “Clean the Board”

A stop hunt is a coordinated effort to push prices into zones where retail traders cluster stop-loss orders. Common targets include:

- Previous highs/lows (e.g., yesterday’s peak or trough).

- Round numbers (e.g., 1.1000 in USD/CHF).

- Session opens/closes (e.g., New York open liquidity spikes).

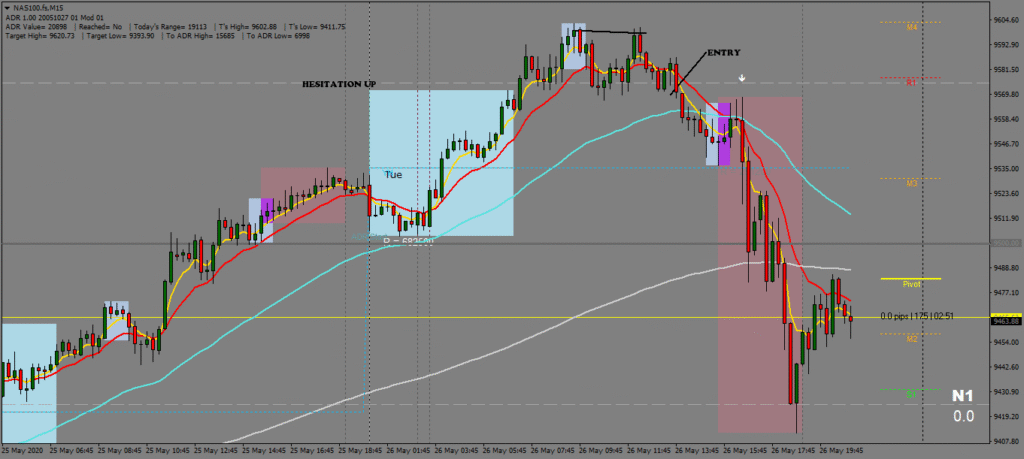

How to Spot a Stop Hunt:

- Sudden Volatility: Prices spike sharply against the trend, often during low-liquidity hours.

- Quick Reversals: After triggering stops, prices reverse direction instantly.

- Liquidity Clusters: Use tools like order book data to identify dense stop-loss zones.

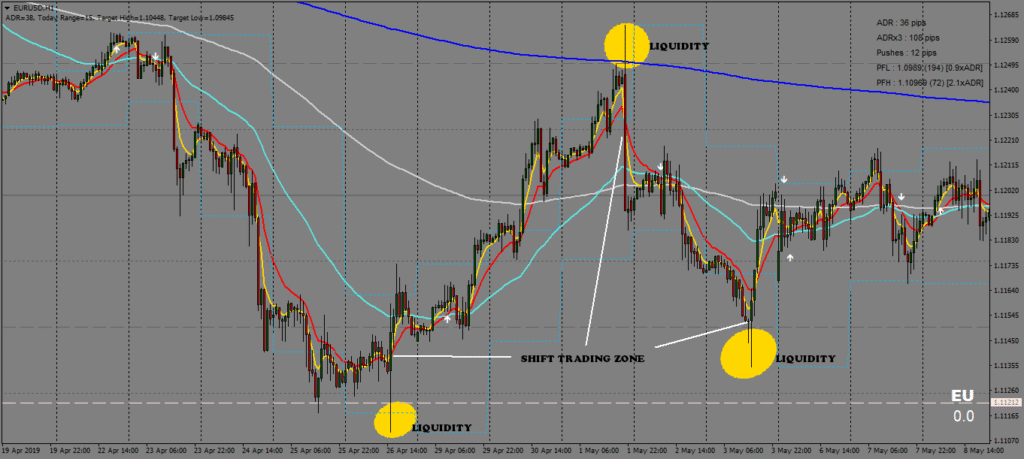

Liquidity Manipulation: The Hidden Game

Market makers rely on liquidity voids and order blocks to engineer price movements. Key tactics include:

- Liquidity Pools:

- MMs target areas above swing highs (for sell stops) or below swing lows (for buy stops).

- Example: A rally to 1.2200 in EUR/USD triggers stops above 1.2180, followed by a swift reversal.

- Fair Value Gaps (FVGs):

- Gaps created by news-driven volatility (e.g., Fed announcements).

- MMs later “fill” these gaps to trap latecomers.

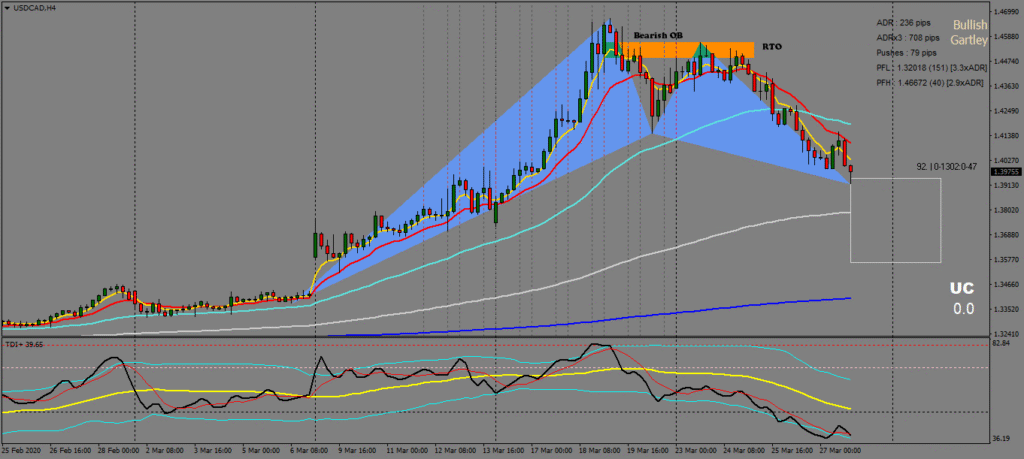

- Order Blocks (OBs):

- Institutional accumulation/distribution zones on higher timeframes (daily/weekly).

- Prices often reverse or accelerate from these zones. They act as support/resistance levels.

How to Trade Along Market Makers (and Win)

- Avoid Obvious Levels: Place stops away from round numbers or recent highs/lows.

- Align with Institutional Flow: Use tools like:

- COT Reports to track smart money positioning.

- EMA Crosses (e.g., 5/13 on 15-minute charts) for confirmation.

- Wait for Confirmation: Let MMs show their hand first. Trade breakouts after liquidity is swept. Always trade after stop hunt is done.

Final Takeaway: Trade Smarter, Not Harder

Market makers thrive on retail traders’ predictability. By understanding their playbook—M/W traps, stop hunts, and liquidity games—you can turn their tactics into opportunities. Remember: Forex isn’t a random casino; it’s a battlefield where knowledge tilts the odds.

Ready to Master Institutional Strategies?

Explore the MQP Alloy Course for advanced charting frameworks, live trade breakdowns, and tools to outsmart market makers.